How Do Our Emotions Affect Our Financial Management?

Are you having money problems?

Money can either be a frustrating problem, or the answer to our prayers! It all depends upon what is happening in our world. Money is required for us to live. We exchange it for goods and services, use it to provide for our necessities, and save it for future needs. When our emotions are on the rocks, what happens to our financial management skills? Are we able to make wise decisions, invest in our future, and provide for our own? Can we recognize the warning signs before we end up in financial ruin?

The emotional connection

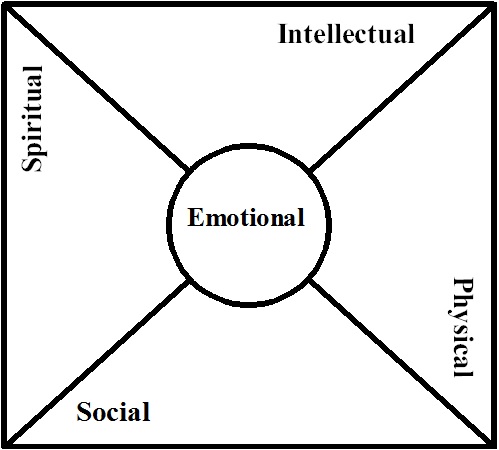

Our emotional health affects every aspect of our lives. It is like the glue that holds us together. It starts with our core concept of who we are and the relationship we have to those around us and goes on to color our thoughts, feelings, desires, and actions.

In The Personal Pinwheel diagram, we see that the center of the pinwheel is labeled "Emotional." It touches all other areas of the pinwheel, the physical, spiritual, social, and intellectual. When the pinwheel is cut on the diagonal lines and the corners with words are brought in and attached to the center, the pinwheel is able to spin. When something happens to the center of the pinwheel, all of the outer wings are affected. If the center disappears, everything falls apart.

The core skills

The five core skills that comprise our emotional health are the very skills we need to be successful financially. They include:

- Problem solving - we depend upon our problem solving ability to make wise decisions regarding what we need to purchase and where the funds come from.

- Conflict resolution - our conflict resolution skills enable us to work with others in our world to set up a financial management system that governs what we do with our money.

- Communication - effective, regular communication about money alleviates misunderstandings and distrust. When others know what we are doing and why, they are more likely to support our plans.

- Resilience - we all experience financial setbacks. Resilience is the ability to bounce back afterward. Whether it is finding new employment, moving to a new location, or even going back to school, we try one thing and then another until we find something that works for us.

- Resource management - money is a natural resource. Our understanding of this vital part of our lives gives us the ability to manage our money successfully. It becomes a tool that enables us to function effectively in society.

Putting our skills into action

As a natural resource, money exists in raw form in our environment, just like water, minerals, and land. We obtain money by tapping into the economic cycle; i.e. gathering raw materials and turning them into products, selling and distributing products to consumers, and providing consumer services.

Our career and job choices determine the amount of money we receive and how we receive it. Once we have money, our financial management skills provide a blue-print for its use. This is done through the following process:

- Putting the money in a safe place - having our money in a financial institution provides banking services, including (but not limited to) checking, savings, money market, debit cards, credit cards, and bill paying services, along with protection of our assets.

- Taking care of essential expenses - paying the “bills” first gives us stability. Expenses such as a place to live, electricity, running water, and transportation usually come in the form of monthly statements. Paying these expenses on time increases our credit rating and establishes our financial security.

- Giving a percentage to charity - giving back to society through charitable donations creates an attitude of gratitude. When we give, we are more likely to care about those who are in less desirable circumstances. Setting aside a certain amount each month for giving puts us in a position to be an asset rather than a liability.

- Saving for future needs - creating a nest egg of funds allows us to make major purchases without incurring debt. We use these funds for such things as appliances, home repairs, school tuition, and vehicles. The more we set aside, the sooner we are ready for the unexpected.

- Budgeting wants carefully - the remainder of our money is allocated for food, clothing, communication, entertainment, and other personal and family desires. Keeping these expenses within reasonable limits allows us to have discretionary funds for the things that we really want.

Emotions and money

Our financial management skills are tested regularly when we enter the market place. Advertisers know that spending money is an emotional experience, and they do everything they can to get us to open our wallets.

If we decide ahead of time what we will purchase, how much we will spend, and when we will walk away, we can get out of the store and back home with money still in our pockets. Remember, there is always a sale, and if we don’t find what we are looking for today, chances are, we will find it later.

We run into problems when our emotions are awry. Our core skills are compromised by the instability of our emotional state, and we fall prey to a number of financial ills. These are shown in the table below, along with their emotional counterparts:

Financial Issue

| Emotional Counterpart

|

|---|---|

Tight-wad

| Anger

|

Impulse buying

| Fear

|

Excessive debt

| Jealousy

|

Fraud

| Sorrow

|

Shopping addiction

| Misery

|

Gambling

| Stress

|

Getting behind on bills

| Overwhelmed

|

Greed

| Hate

|

Returning goods already purchased

| Disappointment

|

Hording

| Worry

|

Indecision

| Embarrassment

|

Any time we succumb to the financial ills listed above, it is necessary to back up and look at our emotional state to see where these problems are coming from. We know that our emotions play themselves out in our desires and passions, and our thoughts govern our emotions. Setting limits and boundaries for ourselves and our loved ones helps us to see the red flags before we hit the crisis point.

Since our emotions are subjective to what is happening around us, the better we get at establishing high quality habits that keep our emotions on an even keel, the better we are at managing our emotional and financial health.

If a family member is having major financial issues, it may be necessary to implement an intervention, just like we would for someone who is addicted. Gathering our family about our loved one and expressing our concern for their financial well-being lets them know that we care for them and love them. We may have to implement some tough love, and get this person professional help to keep them from financially dragging others down with them.

People with mental health issues often have problems with their money. Most communities have organizations that provide financial management services for these individuals. The money that they earn goes into an account with the organization, then their bills are paid and they are given a stipend for personal spending.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2015 Denise W Anderson